Explained: Inclusion of Indian Bonds in Global Indices

Explained the inclusion of Indian G-Secs in JP Morgan's GBI-EM index and its implications on Indian economy.

Hello there,

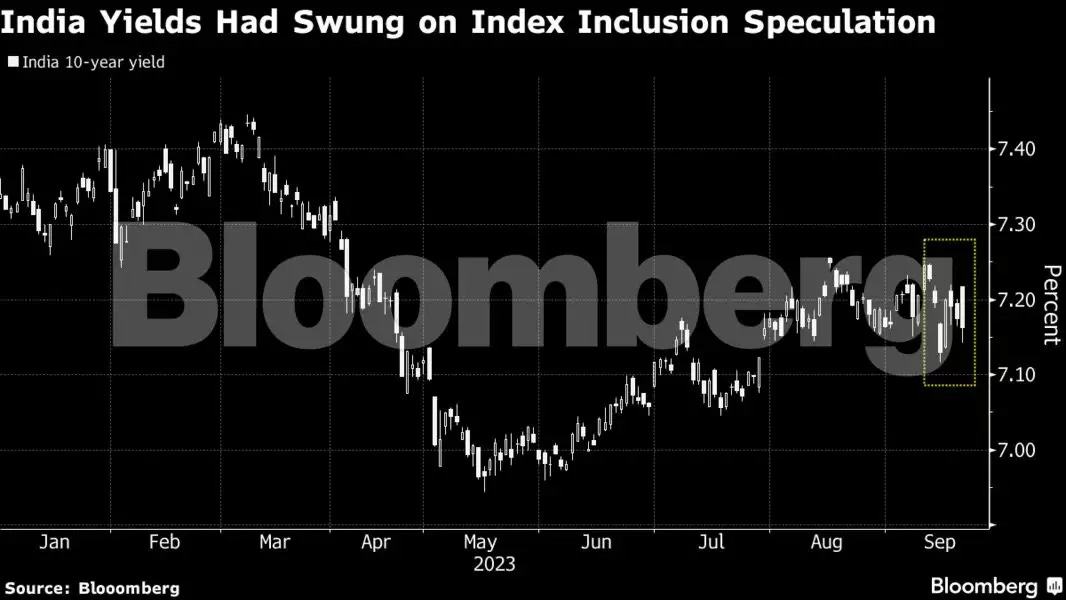

In September last year, JP Morgan included India in its GBI-EM Global index starting June 28, 2024. Today, I will explain the “Inclusion of Indian Bonds in Global Indices” and its implications on the Indian economy, interest rates and currency. Let’s begin!

Note: If my emails end up in the ‘promotions’ tab, please move them to your inbox so you don’t miss out.

In September last year, JP Morgan included India in its GBI-EM Global Diversified Index starting June 28, 2024, with the country’s bonds expected to reach a maximum weight of 10% in the GBI-EM Global Diversified Index. The inclusion of Indian government bonds will be staggered over 10 months (1% every month), from June 28 to March 31, 2025. This development paves the way for global investors to become more comfortable with the Indian markets, positioning India as a major investment destination. It also opens the door for India’s inclusion in other global indices.

What is the JP Morgan GBI-EM Index?

The Government Bond Index–Emerging Market (GBI-EM), launched in June 2005, is the most frequently followed benchmark in the EM local currency-denominated government bond space, tracked by an estimated US$247 billion AUM as of December 2021. It includes only those countries that are directly accessible by most of the international investor base. It excludes countries with explicit capital controls but does not factor in regulatory/tax hurdles in assessing eligibility.

Simply put, JP Morgan’s GBI-EM Global Index is making a basket of government securities (bonds) of 22 emerging countries like China, Indonesia, Malaysia, Thailand, etc. (shown below). It helps investors across the globe follow the index for passive investment strategies.

There are three versions of the GBI-EM index:

GBI-EM Broad Diversified

GBI-EM Global Diversified

GBI-EM Diversified

GBI-EM Global Diversified is the most popular among them, primarily due to its diversification weighting scheme and country coverage. Currently, it is the most widely followed benchmark in its class, with AUM estimated at around US$236 billion as of August 2023. Readers should note that India is already a part of the GBI-EM Broad Diversified Index.

What Does This Hold for India?

After a long time, India was considered for inclusion in the index, much after smaller countries like Poland, Thailand, South Africa, and even Serbia. China entered the index in 2020.

With the Russia-Ukraine war, Russia was dropped out of the index. China has seen economic turmoil for the past couple of years. This left India as the world’s last big emerging market that hasn’t joined others like China on the global debt indices. The emergence of India as the fastest-growing major economy, a stable government, low and stable inflation, high yields, low currency volatility and fiscal discipline makes a compelling argument for Foreign Institutional Investors (FIIs) to invest in Indian government bonds.

India's strong economic growth, far outperforming its neighbours and globally developed economies in times of financial turbulence, is a testament to its effective nation-first policies. As the country’s geopolitical influence grows and large corporations like Apple see India as the replacement of China under the China+1 policy, it is no rocket science to estimate that the inflows are poised to rise in Indian markets.

The index inclusion follows strategic decisions by the government, such as introducing a Fully Accessible Route or FAR. Under FAR, certain specified categories of government bonds would be opened fully for non-resident investors without any restrictions. Eligible investors can invest in specified government securities without being subject to any investment ceilings. This scheme operates along with the two existing routes, the Medium Term Framework (MTF) and the Voluntary Retention Route (VRR). Notably, Indian policymakers conceded no tax concessions or changes to the local settlement.

Foreign investors have bought around US$10 billion worth of Indian government debt after the announcement (shown in the graph above). However, more inflows are expected to come likely from crossover investors, i.e., less index-aware investors who realise the opportunity the Indian market presents.

As per various analyst reports, it is said that Indian bond markets will see an inflow of around US$20 to US$30 billion in the coming 10 months. India became the 25th market to join the index. India has the single highest duration across the index at 7.03 years, with an above-average yield-to-maturity (YTM) at 7.09%. EM Asia’s weight in the GBI-EM GD is expected to go up from 40% now to 47.5% of the total index weight by 1Q25.

Which bonds will qualify for inclusion?

Only bonds classified under the Fully Accessible Route (FAR) will be eligible for index inclusion. Within this subset of Indian Government Bonds (IGBs), 27 FAR-designated bonds meet the index inclusion criteria.

India’s local debt stock is amongst the largest in EM, with the total outstanding bonds included in the index standing at over $400 billion - only surpassed by China.

The bonds with the highest weightage in the index (over 0.5%) consist of 7.18 GS 2033, 7.30 GS 2053, and 7.18 GS 2037.

What Lies Ahead?

Currently, FPIs hold around 2.4% of the outstanding Government Securities, which is likely to increase to around 5% over the next 12-18 months. Index inclusion will help in expanding the investor base which will help the market get more liquidity. As the IGBs get included in these indices, the process of discretionary weighting changes would start to play out, creating a more complex trading environment. In the currency market, where significant dollar investments would boost the rupee, the RBI is expected to use the country's vast forex reserves to smooth out volatility and intervene actively to prevent large spikes and maintain rupee competitiveness.

When active investors decide to go overweight or underweight, they will go towards 12% or 8% of the index, respectively. This 4% gap will regularly play out, translating into an inflow or outflow of US$10 to US$12 billion, a considerable number.

Assuming the central government sticks to the path of fiscal consolidation and targets a fiscal deficit target of 5.1% of GDP, this could result in a net market borrowing requirement of approximately ₹11.9 Lakh Crores. If India can garner US$35 to US$45 billion index-related inflows by March 25, that would help absorb 2% to 31% of net G-sec supply in FY25. That is a substantial one-time relief for fiscal funding and is likely to be offset by lower participation by banks (will help to release funds for credit) and the RBI. The weights of markets after the complete inclusion of Indian G-secs in 2025 are shown below.

International funds quickly react to local and global economic conditions, making index inclusion a double-edged sword. A classic example would be China’s. Within three years of its addition to the international bond index, foreign holdings more than doubled (although it’s hard to verify how much of it was due to inclusion).

In October 2021, when the FTSE Russell added China to its much larger World Global Index, analysts projected US$130 billion of inflows over three years, of which only 10% has materialised which could be resulted due to the global economic slowdown.

After JP Morgan, IGBs will be included by Bloomberg Index Services next year and are also under consideration by Britain’s FTSE Russell Indices. This will draw even more flows from bond and hedge funds and, over time, sovereign wealth, pension, and insurance investors. It will help deepen India’s bond market and currency & interest rate derivatives markets.

Summary

Higher demand for sovereign bonds will put yields under pressure, as has already happened in small measure. Provided the borrowings don’t rise, this could lower government borrowing costs over time. As seen in the past with China, the interest of global investors in IGBs will also be passed on to the corporate bond market, helping corporates raise funds at a cheaper rate. To summarise, this move will help India in many more ways than expected.

Mention your doubts or comments in the comment section, and I’ll try to answer them. To read my previous blog, “The Rise and Fall of Byju’s”, click here. Until then, this is Krishnraj Katariya signing off.

Disclaimer:

The information provided in this blog is strictly for general informational purposes only. All content is personal opinion and does not constitute professional financial advice. We are not SEBI registered, and any action you take based on the information found on this blog is strictly at your own risk. We are not responsible for any losses or damages arising from the use of this blog. Always consult with a qualified financial professional before making any investment decisions.

Insightful!