What are REITs?

Understanding Real Estate Investment Trusts and their rising popularity in India.

Hello there,

REITs have gained significant traction in India's financial landscape over the past few years. Currently, there are four listed REITs in India. REITs offer a unique opportunity for investors to diversify their portfolios while gaining exposure to the real estate sector without directly owning physical properties. In this blog, we'll explore what REITs are, their benefits, and the factors contributing to their rise in India. Let’s get started!

Note: If my emails end up in the ‘promotions’ tab, please move them to your inbox so you don’t miss out.

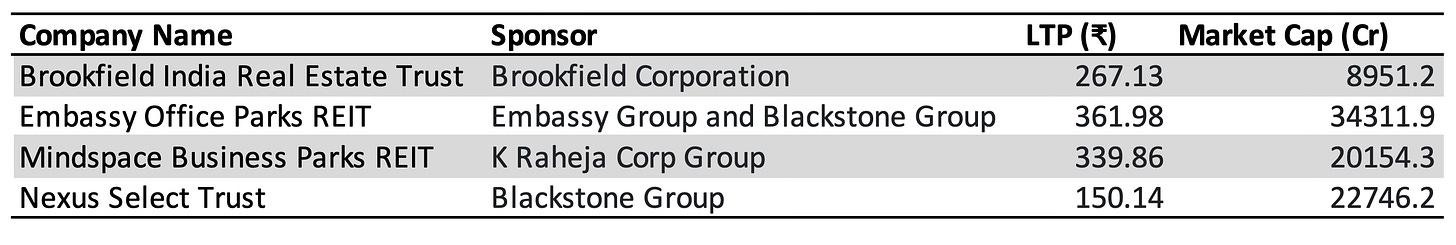

In 2014, securities market regulator SEBI introduced draft REIT regulations for listing of REITs in India. It was in 2019 that the first REIT in India was listed - Embassy Office Parks REIT. After 5 years, today, there are 4 listed REITs in India, namely, Embassy Office Parks REIT, Mindspace Business Parks REIT, Brookfield India Real Estate Trust and Nexus Select Trust.

What are REITs?

Real Estate Investment Trusts (REITs) are entities that allows individuals to invest in real estate. It enables an investor to invest in real estate without having a large sum of money. REITs own, operate, or finance income-generating real estate across a range of property sectors. Similar to mutual funds, REITs pool the capital of many investors to purchase a portfolio of real estate assets, which includes residential properties, office buildings, shopping malls, apartments, hotels, industrial properties, warehouses, etc.

The primary purpose of a REIT is to generate income from rental or lease payments received from the properties it owns. REITs provide an opportunity for investors to invest in real estate without directly owning or managing properties themselves. Instead, they can purchase shares or units of a REIT, which represents their ownership interest in the underlying real estate portfolio.

Benefits of Investing in REITs

Diversification: REITs offer investors the chance to diversify their portfolios by adding real estate to the mix.

Liquidity: Unlike traditional real estate investments, REITs are traded on stock exchanges, providing liquidity and making it easier for investors to buy and sell shares.

Regular Income: REITs must distribute at least 90% of their taxable income as dividends, ensuring a steady income stream for investors.

Professional Management: REITs are managed by experienced professionals who handle the complexities of real estate management, allowing investors to benefit from their expertise.

Tax Efficiency: REITs often enjoy certain tax benefits, which can enhance returns for investors.

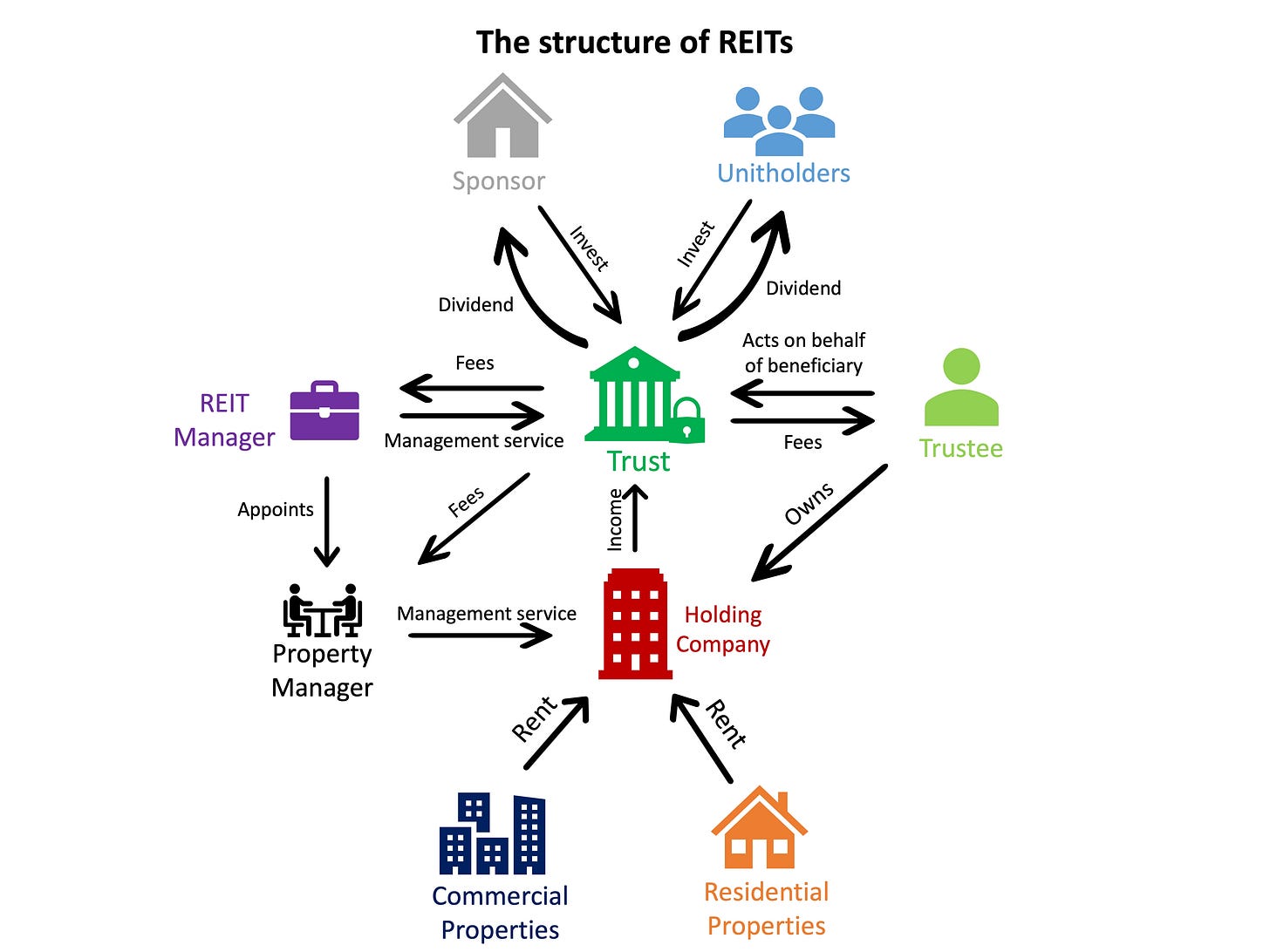

The Structure of REITs

Sponsors: Sponsors are typically large real estate developers, investment firms, or financial institutions that initiate the formation of a REIT. They often contribute a significant portion of the initial property portfolio. Sponsors play a vital role in providing the necessary expertise, assets, and initial capital to get the REIT off the ground. They are similar to the promoters of a normal company and holds a majority stake in the REIT.

REIT Management Team: The management team consisting of professionals, is responsible for the day-to-day operations of the REIT. This includes making strategic decisions about property acquisitions, disposals, leasing, and financing.

Trustees: The trustees oversees the management team and ensures that the REIT is run in the best interests of its shareholders. They provide strategic direction and governance, and their duties include approving major transactions, setting policies, and ensuring regulatory compliance.

Property Managers: These are specialized companies or in-house teams responsible for the maintenance and operation of the REIT’s properties. Their tasks include leasing, rent collection, tenant management, property maintenance, and improvements.

Shareholders/Unitholders: The investors are individuals that own shares of the REIT. They provide the capital needed for the REIT to acquire and manage properties. In return, they receive dividends from the income generated by the REIT’s properties.

REIT can be formed as a trust that holds various assets directly or via a complex structure of holding and subsidiary companies. Let’s understand with an example for better clarity.

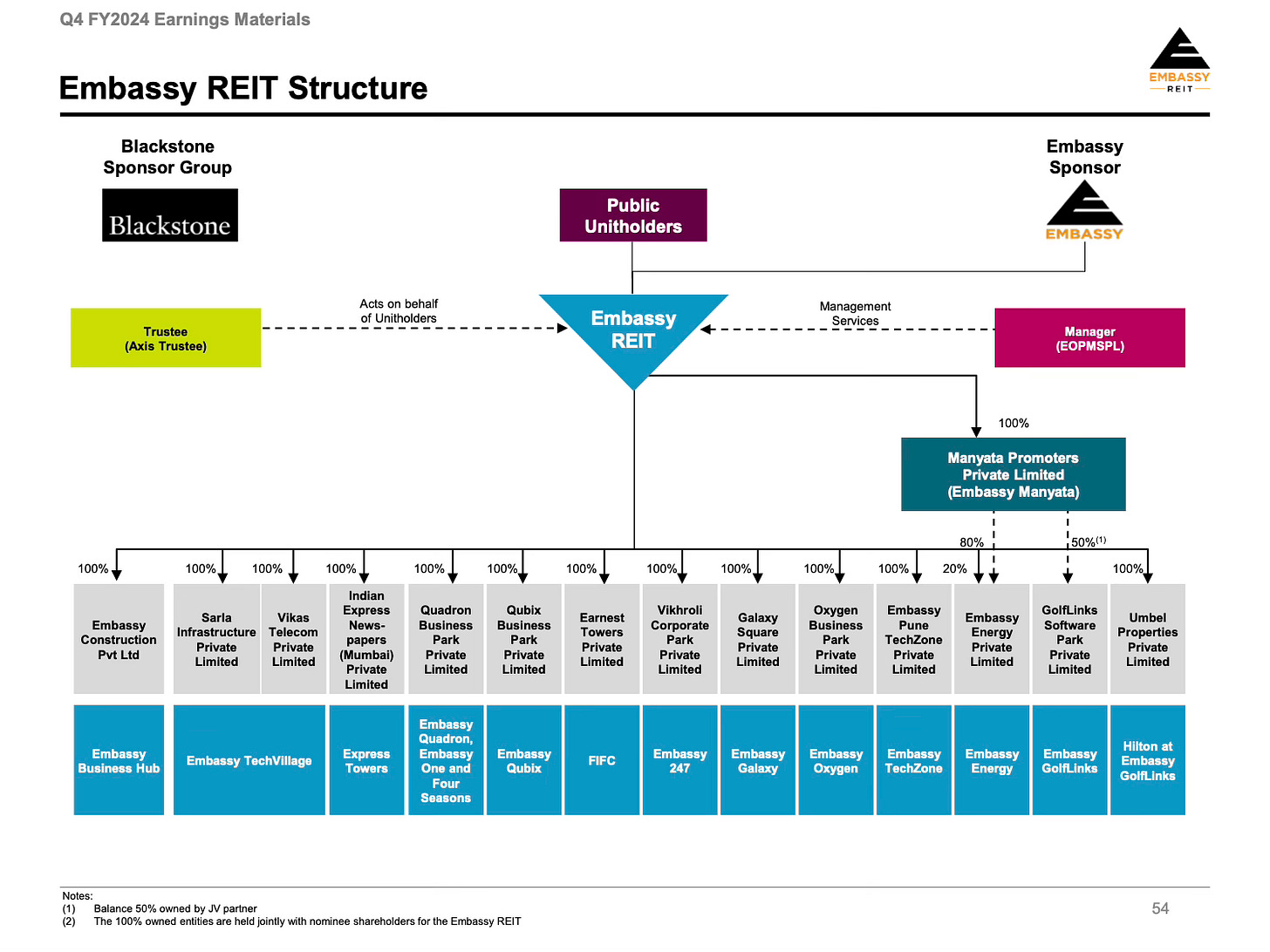

Blackstone and Embassy Group both are the sponsors of Embassy Office Parks REIT. Axis Trustee acts as a trustee of the REIT. Embassy Office Parks Management Services Pvt Ltd (EOPMSPL) acts as the manager of the REIT. The trust has many subsidiaries in its name, which are also known as Special Purpose Vehicles (SPV), through which they own the properties.

Important Regulations for REITs

REITs are tax-exempt, provided they distribute at least 90% of the net distributable income after tax of as dividends to the unit holders at least on a half-yearly basis. At least 80% of the value of the REIT assets needs to be in completed and revenue-generating properties. Remaining 20% can be invested in:

Developmental properties

Listed or unlisted debt of real estate companies

Mortgage-backed securities (MBS)

Listed equity shares of companies deriving at least 75% of their operating income from real estate activity

Government securities

Unutilized FSI of a project

TDR acquired for the purpose of utilization

Money market instruments or cash equivalents

REITs are required to do full valuation on a yearly basis and updating the same on a half-yearly basis and declaring NAV within 15 days from the date of valuation/update.

Key REITs in India

There are currently 4 listed REITs in India (see the table below).

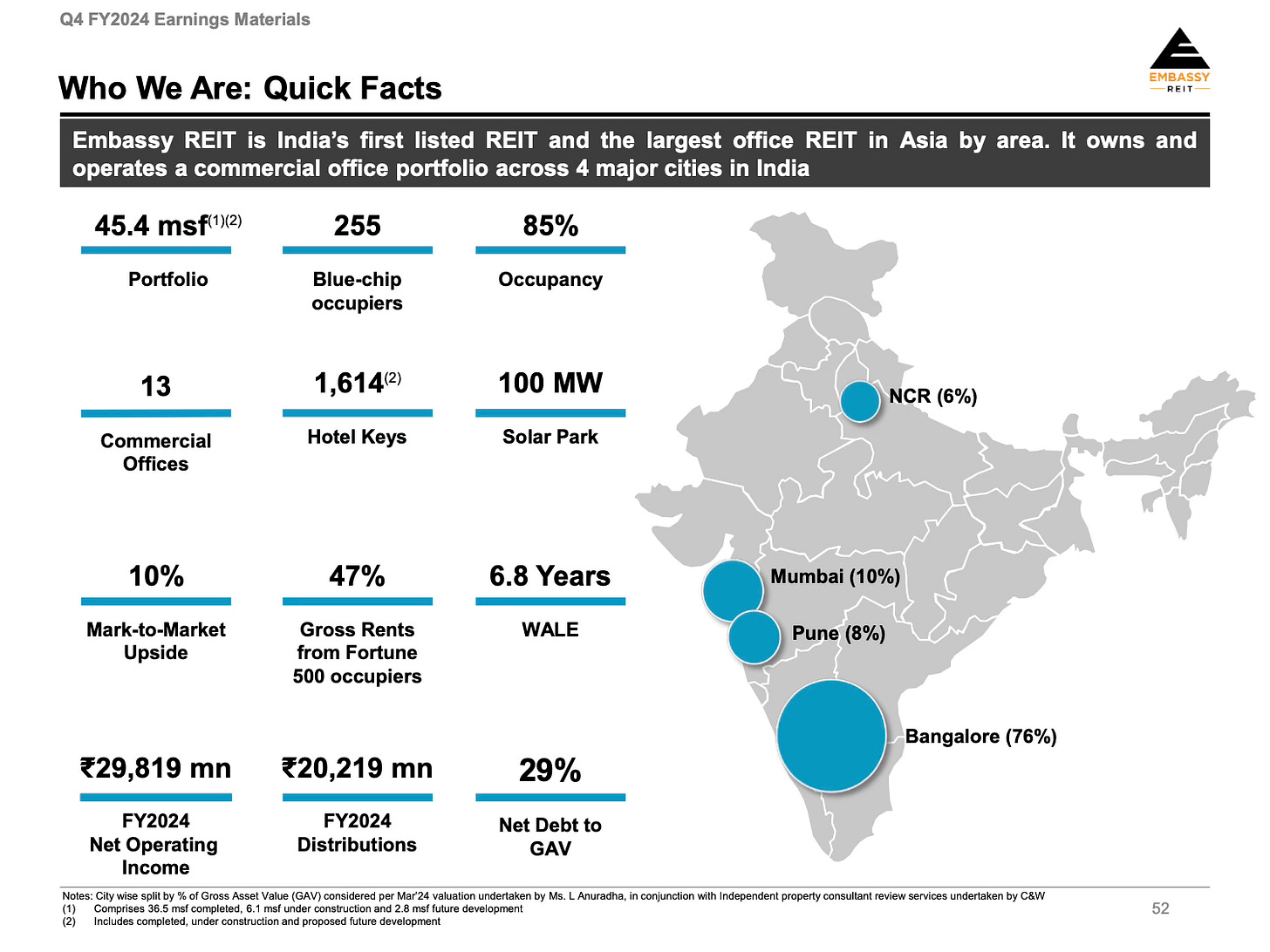

Embassy Office Parks REIT

Listing Date: April 2019

Portfolio: Embassy Office Parks REIT is India's first publicly listed REIT and one of the largest in Asia by area. It comprises 45.4 million square feet of office parks and buildings, hospitality properties, and solar power projects. The REIT's properties are located in key urban centers like Bengaluru, Mumbai, Pune, and the National Capital Region (NCR), catering to a diverse range of tenants, including global technology giants and Fortune 500 companies.

Mindspace Business Parks REIT

Listing Date: August 2020

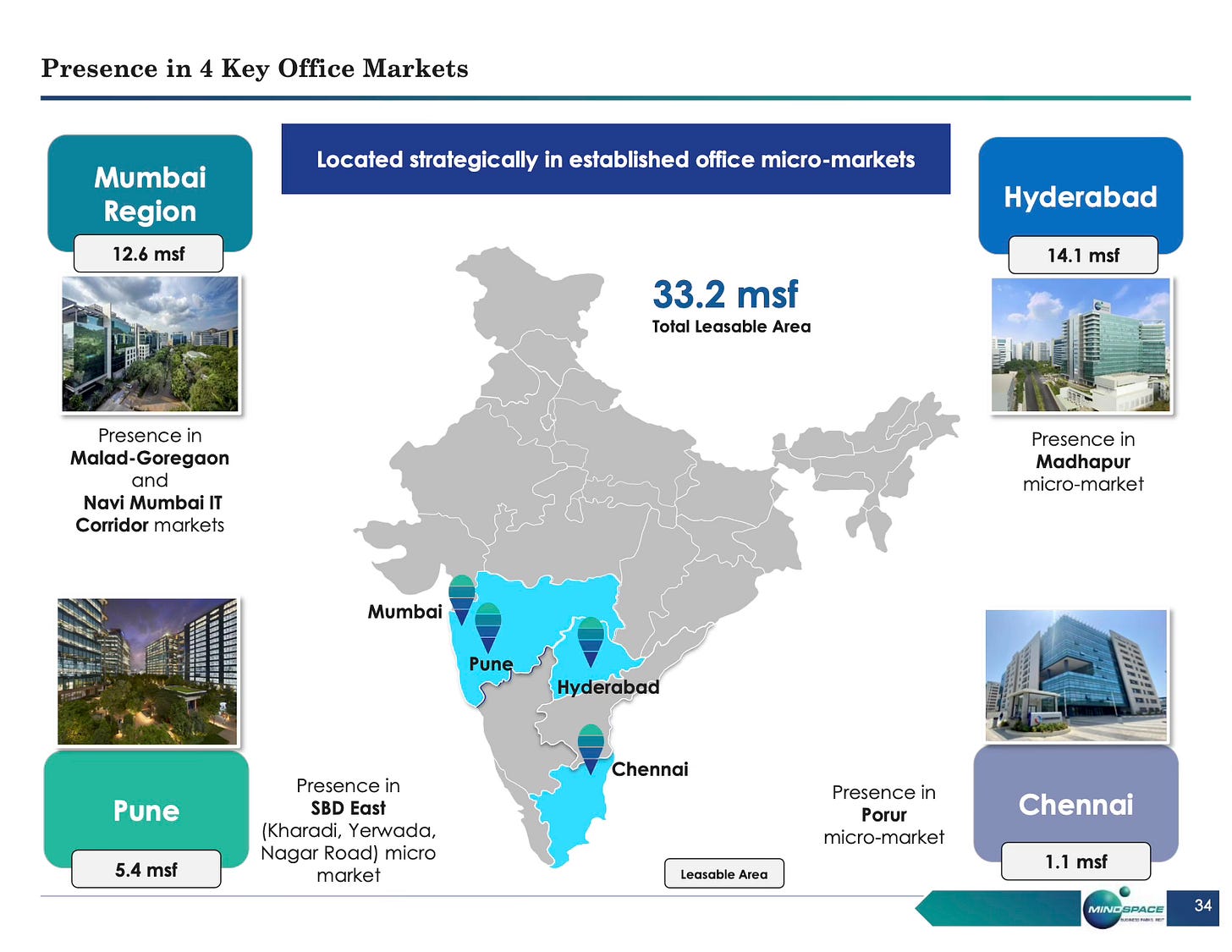

Portfolio: Mindspace Business Parks REIT focuses on Grade A office spaces, with a portfolio spanning 33.2 million square feet across major metropolitan areas such as Mumbai, Pune, Hyderabad, and Chennai. The REIT targets prominent business districts and has a tenant mix that includes leading IT, BFSI, and multinational companies.

Brookfield India Real Estate Trust

Listing Date: February 2021

Portfolio: Brookfield India Real Estate Trust owns and operates a portfolio of high-quality office properties in prime locations across Mumbai, Gurugram, Noida, and Kolkata. Covering approximately 54 million square feet, the REIT's assets include some of the most prestigious office spaces catering to a diverse set of industries.

Nexus Select Trust

Listing Date: May 2023

Portfolio: Nexus Select Trust is India’s first publicly listed retail REIT. Its Portfolio comprises 17 Grade A urban consumption centres with a approximately 9.9 million square feet area spread across 14 cities in India, two complementary hotel assets (354 keys) and three office assets with a Gross Leasable Area of 1.3 million square feet.

Summary

REITs have revolutionized India's investment landscape by offering exposure to real estate with the liquidity of stock trading. Since SEBI's regulations in 2014, four REITs have emerged: Embassy Office Parks REIT, Mindspace Business Parks REIT, Brookfield India Real Estate Trust, and Nexus Select Trust. As the REIT market continues to grow, it offers a promising investment avenue for both retail and institutional investors in India.

Mention your doubts or comments in the comment section, and I’ll try to answer them. To read my previous blog, “Inside India's Largest PE Deal”, click here. Until then, this is Krishnraj Katariya signing off.

Disclaimer:

The information provided in this blog is strictly for general informational purposes only. All content is personal opinion and does not constitute professional financial advice. We are not SEBI registered, and any action you take based on the information found on this blog is strictly at your own risk. We are not responsible for any losses or damages arising from the use of this blog. Always consult with a qualified financial professional before making any investment decisions.