Inside India's Largest PE Deal

From family disputes to company's restructuring to launching IPO, everything you need to know about the Haldiram's deal

Hello there,

Recently, Money Control reported that Blackstone led consortium with Abu Dhabi Investment Authority (ADIA) and Singapore’s sovereign fund, GIC Pte., were in advance talks with India’s leading snack brand Haldiram’s. If went by successfully, this will be India’s largest PE Deal to the tune of US$6 billion-plus. From a side hustle to a multi-billion dollar business, from family disputes to the company’s restructuring, from talks of launching an IPO to making a PE deal, this is the story of Haldiram’s. Let’s get started!

Note: If my emails end up in the ‘promotions’ tab, please move them to your inbox so you don’t miss out.

In July 2024, Money Control reported that Blackstone led consortium with Abu Dhabi Investment Authority (ADIA) and Singapore’s sovereign fund, GIC Pte., were in advance talks for acquiring a controlling stake of about 76% in India’s leading snack brand Haldiram’s. If went by successfully, this will be India’s largest private equity (PE) deal. This blog outlines all the developments in the acquisition story of Haldiram’s till date.

Humble Beginnings

Haldiram’s was started by Ganga Bhishen Agarwal, fondly known as Haldiram, in Bikaner, in 1937. He invented the recipe of the famous Bikaneri Bhujia by using moth (a lentil) flor instead of using besan (gram flour). He named it Dungar Sev after the maharaja (king) of Bikaner and charged a premium as compared to is competitors. Soon, the business started picking up, and traders all across India who came to Bikaner for business started taking bhujia with them for their friends and family.

Now, for all my non-Indian readers, Bhujia (shown above) is a namkeen (savoury) snack eaten in almost every household in India. It has fragrant spices like cumin, black pepper, etc. and aromatic herbs in it with a crispy texture. It has a perfect balance of spice and mildness, making it an excellent choice for individuals who prefer a snack with a more subtle kick.

The Haldiram Family

As mentioned in the book “Bhujia Barrons” by Pavitra Kumar, Haldiram once went to attend a wedding in Calcutta, and on seeing the demand of Haaldiram’s bhujia there, he, with his son Rameshwarlal, established a shop there in 1957.

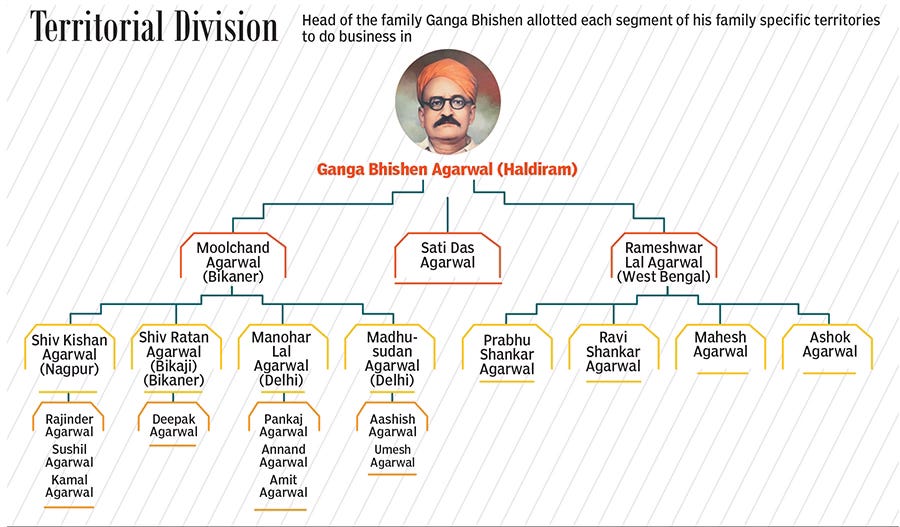

Haldiram had three sons; Moolchand, Satyanarayan, fondly known as Satidas and Rameshwarlal. Due to internal family disputes, he divided the business among the three brothers. Rameshwarlal and Satidas were made in-charge of Calcutta, and Moolchand headed Bikaner. After some time, Satidas broke ties with his brother Rameshwarlal and started his own brand, “Haldiram & sons”.

The Expansion

Under Moolchand, the business of Bikaner started flourishing. Moolchand had four sons; Shivkishan, Shivratan, Manoharlal and Madhusudan. In 1970, Manoharlal and Shivkishan expanded their business in Nagpur. This was the first branching out of the Bikaner bhujia business. Calcutta, the city of the first shop, also became the location for their first manufacturing plant.

The heights by great men, reached and kept,

Were not attained by sudden flight.

But they, while their companions slept,

Were toiling upwards in the night.

- Ralph Waldo Emerson

In 1982, Haldiram’s established its shop in Chandni Chowk, Delhi, which was an instant hit. But to their fate, their shop was burnt down in the 1984 riots. Both brothers, Manoharlal and Shivkishan decided to rebuild the shop again from zero.

Over the next two decades, Haldiram's went through the growing pains of any young company, resulting in divisions in the company. Shivkishan headed Nagpur, Shviratan headed Bikaner, and Madhusudan & Manoharlal were in charge of Delhi. Now the group had truly expanded across India. Bikaner’s division was renamed to Bikaji which also owns the brand Bhujialalji. Kolkata had Haldiram Bhujiawala, Haldiram & Sons and Haldiram Prabhuji. Delhi had Haldirams, and Nagpur was named Haldiram’s Nagpur, which also owns the brand Mo’pleez. Other Group brands include Bhikharam Chandmal and Bikanervala which owns the brand Bikano. See figure below.

The Kolkata faction dragged Nagpur and Delhi to court over the ownership rights of the brand “Haldiram” in the early 1990s, persisting till today. The dispute over the ownership of the brand was primarily between the sons of Moolchand and Rameshwarlal and concerns the alleged dissolution of a partnership between Gangabhisan, Moolchand, Shiv Kishan and wife of Rameshwarlal, which had registered the trademark in 1972.

Today, Haldiram’s has its manufacturing plants in Delhi, Kolkata, Nagpur, Gurgaon, Noida, Rudrapur and Hoogly. It enjoys a market share of about 13% of India’s savoury snack market with more than 150+ operational restaturants. It exports to over 100 countries including USA, UK, UAE and Canada.

The Restructuring

In April 2022, while giving an interview, the three brothers Shivkishan, Manoharlal and Madhusudan told to CNBC TV18 that they were considering raising funds from PEs and wanted to list their company on exchanges in upcoming 2 to 3 years.

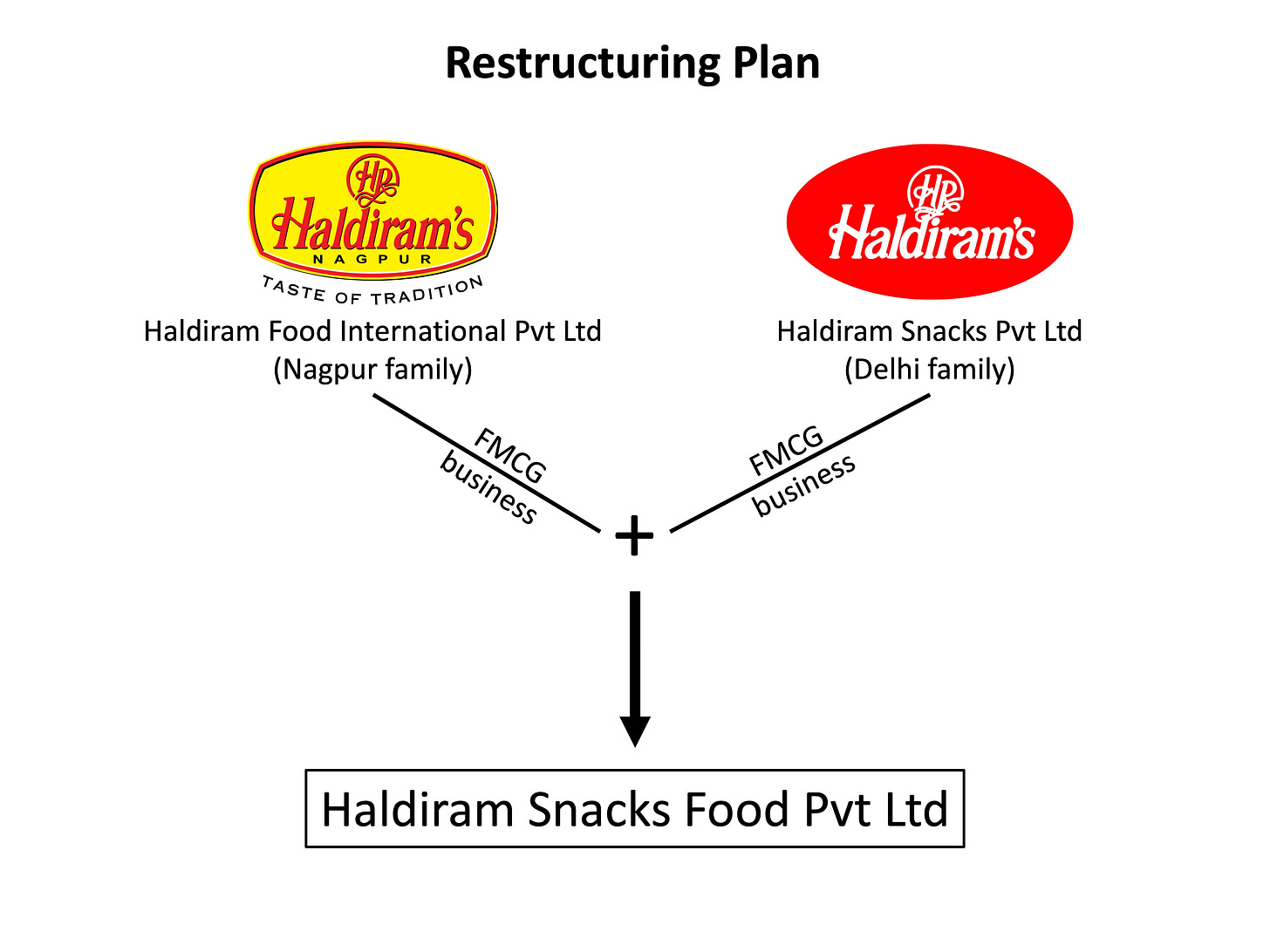

In April 2023, the Nagpur and Delhi factions applied before the Competition Commission of India (CCI) for the restructuring of businesses which was approved by the commission. As per the proposal, the FMCG businesses of Haldiram Snacks Pvt Ltd (Delhi family) and Haldiram Food International Pvt Ltd (Nagpur family) were demerged from existing business and combined into a new entity named Haldiram Snacks Food Pvt Ltd (HSFPL). After the proposed arrangement, the Delhi family will hold 56% and the Nagpur family will hold 44% of stake in HSFPL. (See figure below)

As per the proposal, only the FMCG businesses of the said companies were demerged. The companies would continue their other businesses such as restaurants and selling of loose sweets. The companies applied befor NCLT for the said approval of business restructuring but had faced a claim against HFIPL filed by the Asst. Commissioner of Income Tax, Mumbai of unpaid taxes amounting to ₹40 crores. The next NCLT hearing is scheduled for 14 August 2024.

In May 2023, the company appointed Krishan Kumar Chutani a.k.a. KC as the CEO of the company. KC who is a veteran in the FMCG space has an experience spanning more than 2 decades. Before joining Haldiram’s, KC was the CEO of Dabur’s international business and is credited for expanding Dabur’s reach to international markets.

In September 2023, Reuters reported that Tata consumer products limited, the FMCG arm of the flagship Tata group was reportedly in talks with Haldiram’s for acquiring a 51% stake. It was reported that Tatas wanted to buy more than 51% stake in the company but the deal was called off because of very high valuation asked by the existing owners. The existing promoters of Haldiram’s wanted a valuation of around US$10 billion which takes the price-to-revenue multiple at 6.67x with a revenue of US$1.5 billion. It was also reported that Haldiram’s wanted to raise funds from PE by diluting 10% stake.

As compared to its listed peer Bikaji, the valuation sought is less as the listed company enjoys a price-to-revenue multiple of 7.3x with a valuation of US$2 billion.

The Deal

Since 2016-17, several private equity firms including General Atlantic, Bain Capital, Capital International, TA Associates, Warburg Pincus, Everston have been talking with the Agarwal family for a minority stake or a controlling one.

In June 2024, Bloomberg reported that Haldiram was exploring IPO opportunities with expected valuation of US$12 billion which went unmet. It also reported that a consortium led by Blackstone which included Abu Dhabi investment authority (ADIA) and Singapore’s sovereign fund GIC pte and another consortium led by Bain & Co. and Temasek Holdings submitted their non-binding offers to acquire a majority stake in HSFPL.

As per the latest news by ET, Blackstone and its partners are keen to buy 74-76% of the company, valuing the business at US$8-8.5 billion.

Summary

It is a good sign for India that private equities are now interested in investing in traditional Indian businesses rather than hot startups. We should also consider the fact that PEs simply work for profit. They can take any step, including selling off assets and filing for bankruptcy, as seen in many cases in the US. As they say there is a very thin line between capitalism and crony capitalism, one is healthy, another is corrupt. We should be in a position where PEs don’t end up messing with our assets at a national level.

Mention your doubts or comments in the comment section, and I’ll try to answer them. To read my previous blog, “Explained: Inclusion of Indian Bonds in Global Indices”, click here. Until then, this is Krishnraj Katariya signing off.

Disclaimer:

The information provided in this blog is strictly for general informational purposes only. All content is personal opinion and does not constitute professional financial advice. We are not SEBI registered, and any action you take based on the information found on this blog is strictly at your own risk. We are not responsible for any losses or damages arising from the use of this blog. Always consult with a qualified financial professional before making any investment decisions.